- #Acorn investment reviews how to

- #Acorn investment reviews full

- #Acorn investment reviews professional

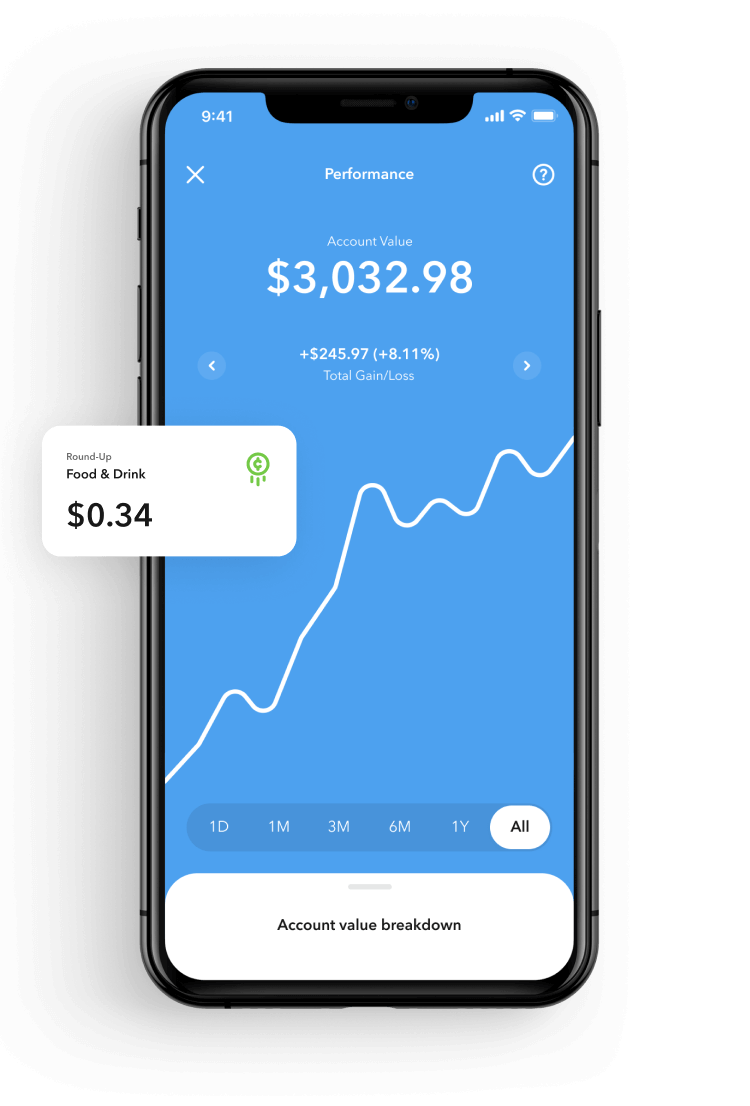

Once you’ve set up your account and completed your investment profile, the Acorns app can do the rest of the work for you. You can get started with as little as $5. The Acorns app rounds up your spare change to the nearest dollar and invests that money for you. It’s a great way to start investing in the stock market, even if you don’t have a lot of money. You don’t need a lot of money to start investing If you’re new to investing, you’ll likely enjoy the following pros of using the Acorns app. Here are the major pros and cons of the Acorns app to help you decide if it’s the right investment tool for your financial goals. You’ll have to experiment a bit to find the method that works best for you. There’s no perfect way to start investing. The Acorns Family Account costs $5 per month and includes:

The Acorns Personal Account costs $3 per month and includes: Your options are the Personal Plan or the Family Plan. How Much Does Acorns Cost?Īcorns charges a monthly subscription fee and the cost depends on which plan you choose. But, still, it also means you can make money. So, what does that mean for you and the Acorns app? It’s important to remember that when you’re using Acorns (or any other investment tool), your investments are subject to market risk. Why? The stock market is ever-changing, which means that the value of stocks can go up or down without any warning. There is no way of guaranteeing that you’ll make money when you invest in the stock market. You need to know that with any investment strategy, tool, or app–there is some risk. But, if you stick with it, you’ll (hopefully) see your account balance begin to grow over time. It may not sound like much, but over time those fractional shares can add up! And that’s where the Acorns app comes in… For a while, it may seem like you’ve barely invested enough money to matter.

#Acorn investment reviews full

When you buy fractional shares, you’re buying a percentage, rather than a full share of stock. What’s a fractional share?Ī fractional share is a piece of a company’s stock.

When you micro-invest, you don’t need to have enough money to buy an entire share of stock. Micro-investing is an investment strategy that allows you to invest small amounts of money into stocks, bonds, ETFs and other securities. But you can also directly deposit money into your Acorns investment account to get started right away.īut, still, how is that $5 minimum enough to make an investment? Micro-investing. Round-Up investments from your checking account will be swept to your Acorns investment account when your accrued Round-Ups® reach or exceed $5.

The Acorns app will round up your purchase to $13 and put the extra $0.50 into your investment account. The premise behind Acorns is simple: the app rounds up purchases made using your credit or debit card so you can invest your spare change into the stock market.įor example, let’s say tomorrow your lunch costs $12.50. Now, if you know anything about how much even a single share of stock costs, then you also know $0.50 usually isn’t enough to invest in much of anything.

One of its defining features is that it helps you save and invest your spare change.įor example, if you have $0.50 to spare, Acorns can help you invest that money in a portfolio of ETFs (exchange traded funds). But, first, let’s talk a little bit more about… What Is Acorns?Īcorns is one of the most popular investing apps on the market with over 4.7 million subscribers.

#Acorn investment reviews how to

Our blog posts may also contain affiliate links that, at no cost to you, may earn us a small commission.īut if you decide you do want to give Acorns a try, we’ll also walk you through how to sign up for Acorns and begin using the platform to invest.

#Acorn investment reviews professional

For that, you’ll need to speak to a professional financial advisor. It should not be taken as financial advice.

0 kommentar(er)

0 kommentar(er)